Trust Ora Invest INHERITANCE

Wealth Planning Tools to Protect Your Future

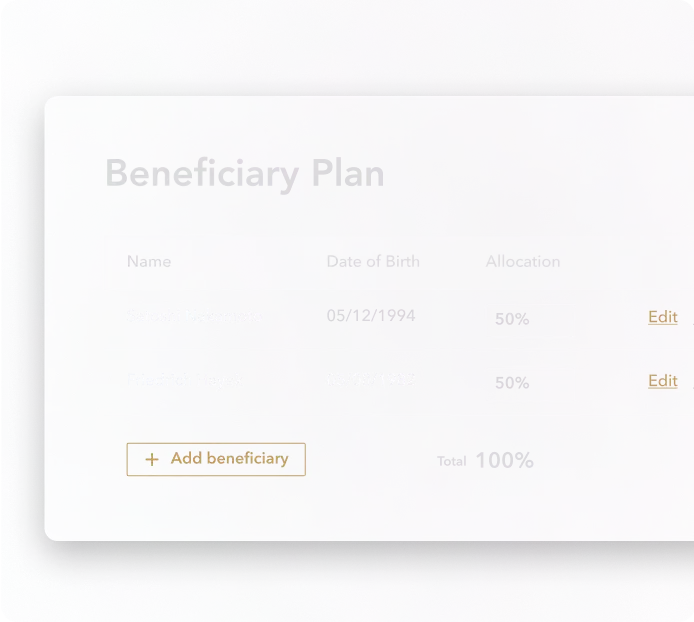

Account Beneficiary Management

Design a personalized beneficiary plan to seamlessly transfer your assets to your loved ones.

Personal Investment Trust Account

With Trust Ora Invest, you can include cryptocurrency in your personal investment trust within 48 hours.

Asset Concierge Support

Our U.S.-based Client Services team will help you set up your beneficiary plan and guide your loved ones in understanding cryptocurrency.

Peace of Mind in Just Minutes

A Trust Ora Invest beneficiary plan gives you full control over how your assets are distributed.

Customize your plan with flexible beneficiary structures tailored to your needs.

View, modify, or add a beneficiary plan whenever you choose.

Your assets stay securely in cold storage, bypassing public legal proceedings.

Rest assured your loved ones are in good hands.

Trust Ora Invest supports your beneficiaries as the next generation of investors.

We educate your loved ones about cryptocurrency, guide them through the transfer process, and provide hands-on support in mastering custody best practices.

Frequently asked questions

Need more details? Explore our blog for an in-depth look at account beneficiaries, or contact our Client Support team for personalized assistance.

How to Designate a Beneficiary

To designate a beneficiary, log in to your Trust Ora Invest account and choose the brokerage account where you want to add a plan. Then, click on the “Beneficiaries” tab and follow the prompts to create your plan.

Is there a limit to the amount of assets I can assign to a beneficiary?

No, there’s no limit to the amount of assets you can assign to a beneficiary. For personalized guidance on your beneficiary plan options, our Relationship Management team is ready to assist you.

If my assets are held in an Investment Trust, do I still need to designate a beneficiary?

No, designating a beneficiary is not required. Your assets will be distributed according to your established investment trust. For estate planning guidance, reach out to our Private Client team today.

Which estate planning entities does Trust Ora Invest support?

Trust Ora Invest supports Limited Liability Companies (LLCs, including IRA LLCs), trust accounts (including IRA trusts), and solo 401(k) plans.